Salary thresholds defined under the Fair Labor Standards Act will update every three years based on up-to-date wage data. As a result, your salaried position may need to convert to hourly. Although these changes are designed to protect employees, you may still have questions.

This webpage is a general reference for University employees to help answer your questions. Please work with your supervisor to understand unit expectations.

2024 FLSA Compensation Threshold Increases

On April 23, 2024, the Department of Labor (DOL) announced planned updates to the Fair Labor Standards Act compensation threshold, one factor in determining whether a position can be exempt from overtime requirements.

If the following upcoming minimum thresholds are above your salary, you may be impacted.

New Threshold Impact on Employees

What will not change

- Your Full Time Equivalency (FTE) or pay rate. (Your pay rate will convert to an hourly rate based on a 40-hour workweek and prorated by your FTE.)

- Your time off accruals.

- Your taxes and/or withholdings.

- Your benefits or retirement elections and contributions.

- Your career architecture mapping elements (pay grade, career level/stream, job function/family)

- Your job duties and job description.

What will change

- You are now a Positive Time Reporter and must report every “paid time” hour worked.

- You are now eligible to receive overtime compensation.

- All overtime you work must be pre-approved by your supervisor.

- Any overtime you work will be compensated as pay or with compensatory time accrual (paid time off, like vacation).

- Any hours you work more than your regular hours in a workweek up to 40 hours will be compensated at your regular rate.

- Any hours you work more than 40 hours in a workweek will be compensated at 1.5 times your regular rate.

Calculating Your Pay

Transitioning from salaried to hourly

Fiscal Year Calculation:

Annualized Salary / 2,080 hours * FTE

Academic Year Calculation:

Annualized Salary / 1,600 hours * FTE

Example:

A 1.0 FTE salaried fiscal-year employee makes $50,000 annually.

$50,000 / 2,080 hours * 1.0 FTE = Hourly rate of $24.04.

Transitioning from hourly to salaried

Fiscal Year Calculation:

Hourly Rate * 2,080 hours * FTE

Academic Year Calculation:

Hourly Rate * 1,600 hours * FTE

Example:

A 1.0 FTE hourly fiscal-year employee makes $32.00/hour.

$32.00 * 2,080 hours * 1.0 FTE = Salary of $66,560

Key Things for Hourly Employees To Know

Overtime Defined

Overtime refers to hours worked beyond an hourly employee's regular hours. All overtime must be approved by your supervisor/time approver prior to being worked. There are two kinds of overtime rates:

Straight Overtime: When an hourly employee works over their assigned hour but less than 40 hours in a workweek, overtime is paid at their regular hourly rate.

Time and a Half Overtime: When an hourly employee works more than 40 hours in a workweek, overtime is paid at 1.5 times their regular rate.

Recording Your Time

Hourly employees must report all paid hours on the actual day worked, and their supervisor/time approver must approve all hours each pay period. Paid time is considered all time for which an employee receives compensation, including work and paid time off.

Helpful resources and information:

Compensatory (Comp) Time

Comp time compensates employees for overtime hours by giving them time off instead of pay. It is the default option when reporting overtime in UAccess.

- Comp time is accrued at either straight or time-and-a-half overtime rates, depending on the employee's regular hours and the number of hours worked.

- Accrued comp time balances are displayed in UAccess alongside vacation and sick time balances.

- When comp time is used, it is paid at the employee's most recent pay rate.

- Accrual of comp time above a balance of 120 hours (prorated by FTE) must receive a written exception from college/division leadership. The max comp time balance is 240 hours (prorated by FTE).

Understanding What Supervisors Can and Cannot Do

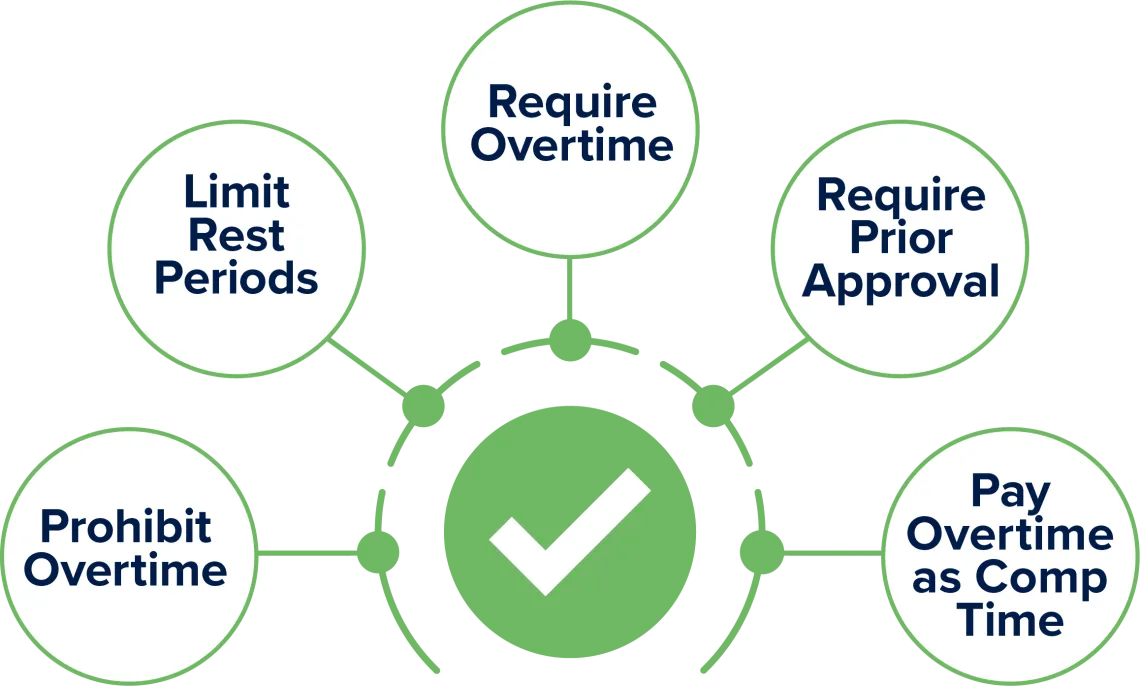

Supervisors CAN

| Require you to work more than your regular hours in a workweek. |

| Prohibit you from working more than your regular hours |

| Require you to receive approval before working more than your regular hours in a workweek. |

| Request that you be compensated with either compensatory time or cash payment. |

| Prohibit or limit paid rest periods if not established college or division practice. |

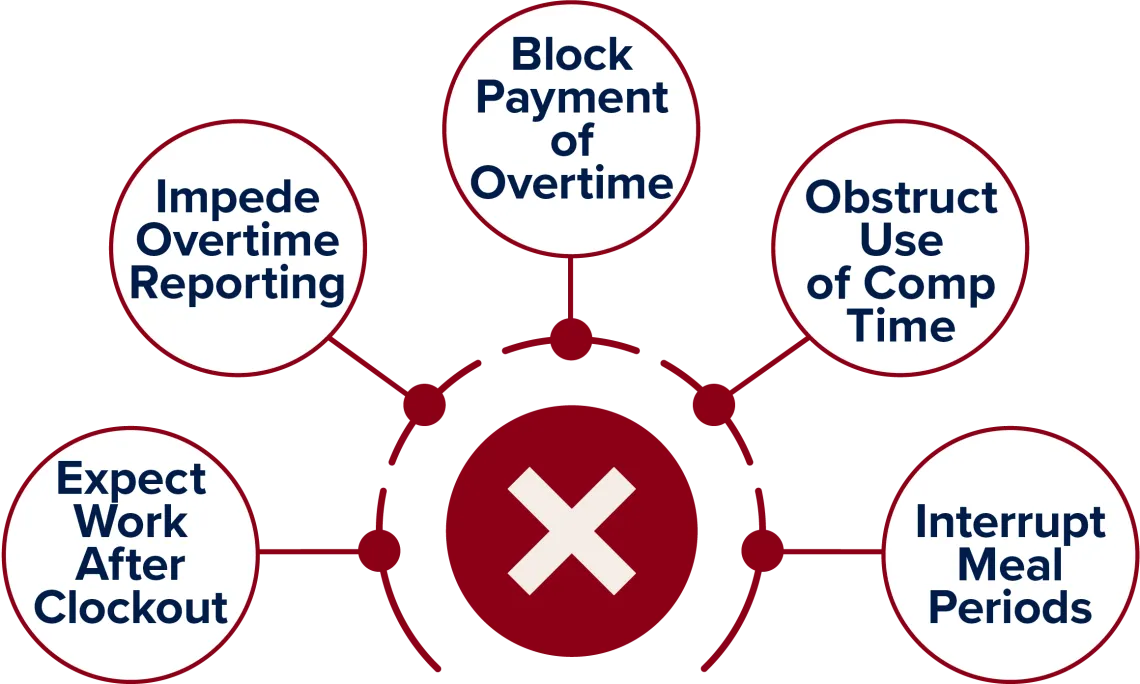

Supervisors CANNOT

| Ask you to clock out and continue working. |

| Pressure you into an unspoken "don't ask, don't tell" situation in which you implicitly know you are expected to work more than your regular hours without overtime pay (e.g., answering emails/calls after hours). |

| Prevent you from being compensated for overtime, even if you worked more than your regular hours without prior approval. |

| Make it more difficult to use compensatory time compared with other accrued time off. |

| Require you to work an 8-hour workday without an uninterrupted meal period of at least 30 minutes (unless there is a specific departmental exception). |

Frequently Asked Questions

Human Resources will contact employees and their supervisors via email leading up to the change date.

No. This change is mandated by the U.S. Department of Labor. An employee and employer cannot agree to waive or disregard any of FLSA's requirements.

FLSA established three tests that must be met for an employee to be exempt from overtime eligibility

| Salary Level Test | Salary Basis Test | Duties Test |

|---|---|---|

| Employees are considered overtime eligible (hourly) if they earn below the FLSA threshold. | Salaried employees are paid on a salary basis, meaning pay doesn't change from a fixed, predetermined amount regardless of variations in work schedule in a given workweek. |

Certain positions are considered exempt due to the nature of their job duties. These include executives, administrators and other roles requiring specific skills or education. Review the University's FLSA and Overtime Policy "Exemption Tests" section. |

Not likely. Teachers (along with several other employment categories) are exempt from FLSA regulations. However, California and Illinois have different regulations that affect faculty exemptions.

No. All hours worked must be paid work hours. Any hours that exceed 40 hours in a workweek must be paid at 1.5 times the employee's regular rate.

Not necessarily. The FLSA thresholds change and corresponding reclassifications are based on pay rate, not title or job description.