This webpage is a general reference for supervisors of employees who get reclassified from exempt (salaried) to nonexempt (hourly, entitled to overtime)*. Please contact your HR team, Payroll Services, and the Office of Budget and Planning as necessary to plan for and receive individual guidance.

*Although not all salaried employees are exempt from overtime rules under the Fair Labor Standards Act, for ease of communication, the university will be referring to exempt employees as “salaried,” and non-exempt employees as “hourly” or “overtime eligible.”

Actions Necessary as Supervisors

Changes in Fair Labor Standards Act (FLSA) or state regulations may require that a direct report gets reclassified from salaried to hourly. This means that they become positive time reporters and will be entitled to FLSA protections, including overtime pay or compensatory time accrual.

In alignment with the FLSA and Overtime Policy, it is the supervisor's responsibility to consider rescheduling priorities, reassigning work, rebalancing workloads, or offsetting hours during the same workweek before approving overtime hours.

Tips for Supervisors

Before reclassification occurs

- Meet with impacted direct reports to ensure they understand overtime policies, procedures and expectations.

- Check with department leadership to confirm expectations regarding meal and break times or compensatory time accrual.

- The Time and Labor: Supervisor Responsibilities training has been updated. Consider retaking it as a refresher.

After reclassification occurs

- In UAccess, check under the employee's Time Reporting Code column for anything that shows as "invalid value." Pre-populated holidays and winter closure time, in addition to any time off and leave requests already entered, may need to be corrected by you or the impacted employee.

- Before authorizing overtime, explore all alternatives, such as changing priorities, reassigning work, or offsetting excess hours with reduced hours in another day in the same workweek.

- You and your business office will receive notifications if your direct report exceeds the max comp time accrual balance of 120 hours. College/division leadership may grant an exception for up to 240 hours, but please be mindful of your employees' balances.

Resources for Supervisors

- Your HR Team - Guidance in planning for more hourly workers on your payroll.

- Salary vs Hourly - General resource to explain key things to know.

- Time Approver Duties - Responsibilities of being a Time Approver.

- Time Coordinator Duties - Information about timekeeping, payroll processing, the Fair Labor Standards Act and payroll exceptions.

Managing Hourly Employee Overtime

Please visit the Salary vs. Hourly webpage to learn about overtime and compensatory time.

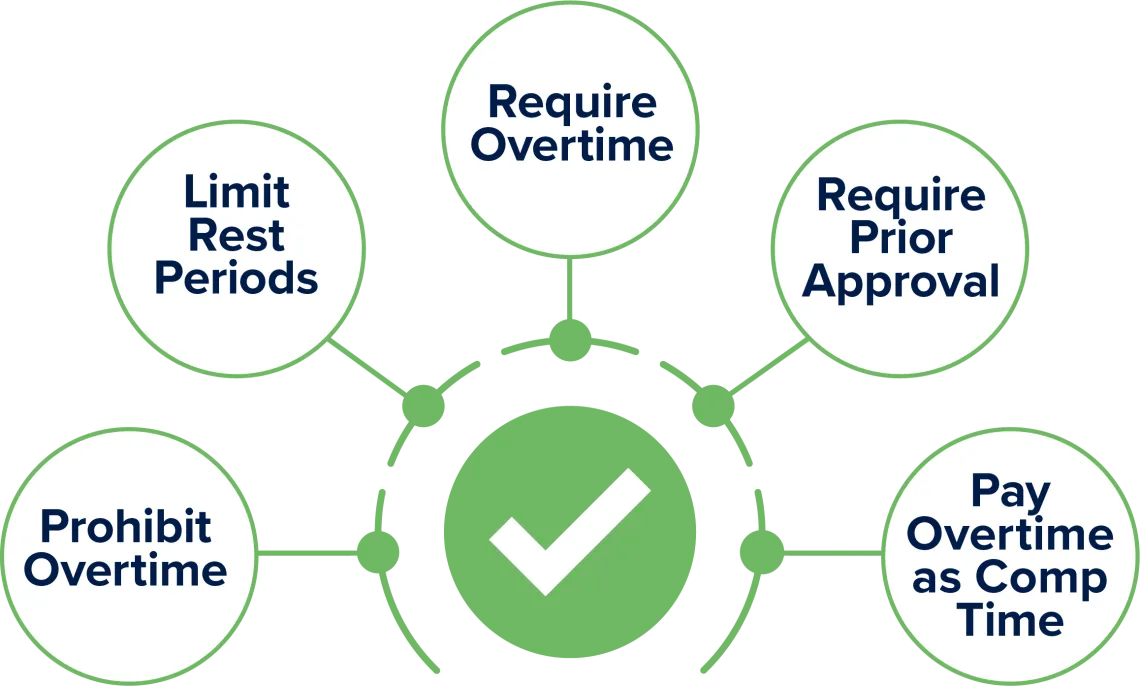

Supervisors CAN

| Require employees to work more than their regular hours in a workweek. |

| Prohibit employees from working more than their regular hours |

| Require employees to receive approval before working more than their regular hours in a workweek, which may include corrective or disciplinary action if they do not. |

| Request that employees be compensated with either compensatory time accrual or cash payment. |

| Prohibit or limit paid rest periods if not established department, college, or division practice. |

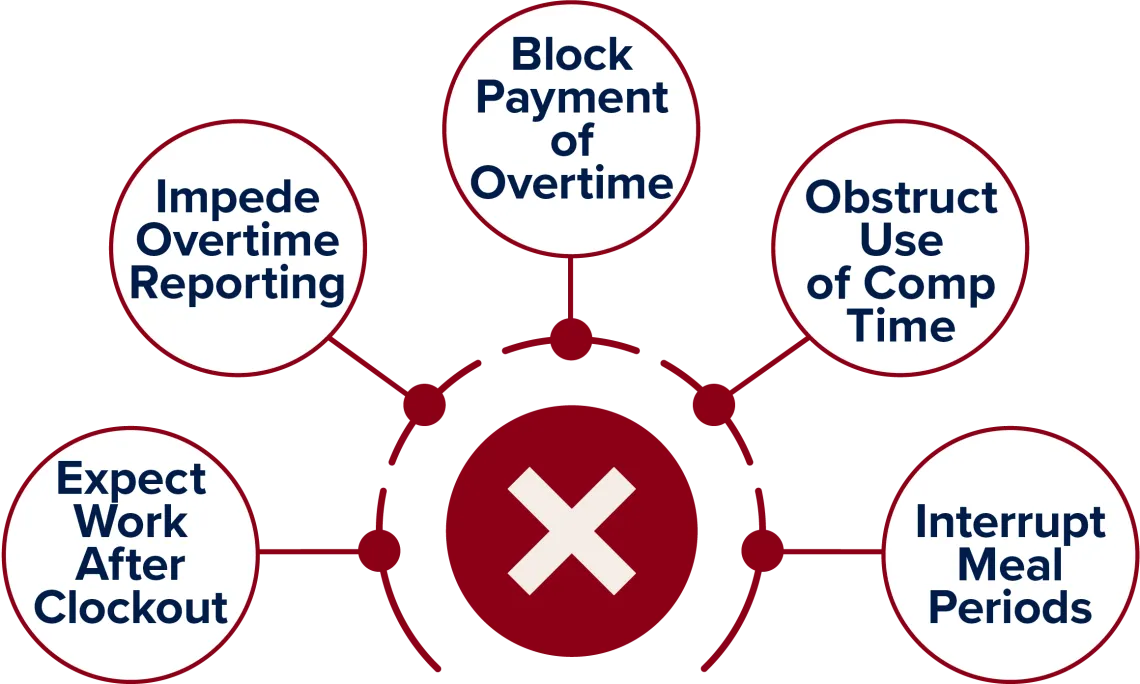

Supervisors CANNOT

| Ask employees to clock out and continue working. |

| Pressure employees into an unspoken "don't ask, don't tell" situation in which they implicitly know they are expected to work more than their regular hours without overtime pay (e.g., answering emails/calls after hours). |

| Prevent employees from being compensated for overtime, even if they worked more than their regular hours without prior approval. |

| Make it more difficult to use compensatory time compared with other accrued time off. |

| Require employees to work an 8-hour workday without an uninterrupted meal period of at least 30 minutes (unless there is a specific departmental exception). |

Frequently Asked Questions

Human Resources will either contact employees and their supervisors via email leading up to the change date, or HR teams will guide units to do so.

In addition, you may contact your area's business office or your HR team for assistance.

Determining salaried/hourly status may be challenging based on state laws, FTE, stipends, allowances, etc. You do not need to navigate or calculate on your own. Human Resources is here to support you. If you have questions, please contact your HR team of generalists and subject matter experts.

Yes, an employee may shift hours around within a given workweek to stay within their regular hours. In fact, as a supervisor, you must explore all options to facilitate this before considering overtime. This may include rescheduling priorities, reassigning work, re-balancing workloads and even revising the employee’s work schedule so that weekend work is performed as a regular part of the workweek.

You may not shift hours across weeks.

Generally, it is not appropriate to set or change salary to avoid FLSA or state regulations. It is also not necessary for colleagues doing similar work to all have the same salaried or hourly status, even if they have the same title, job function/family or career level.

However, certain positions may have large fluctuations in workload based on seasonality or project cycles or receive allowances and stipends, which can cause budgetary or other logistical considerations for units. Please contact your HR team of generalists and subject matter experts to work through individual situations and strategize options.

Yes. Categories of employment outlined in the Fair Labor Standards Act and Overtime Policy “Exemption Tests” section (Department of Labor Fact Sheets 17A-E and S) are exempt from FLSA regulations.

If you have questions about the salaried or hourly status of a direct report or planned new position posting, please contact your HR team of generalists and subject matter experts.

For questions about how various compensation elements (allowances, stipends, OPS and more) affect the salaried or hourly status of a position, please contact your HR team of generalists and subject matter experts.

If an employee has concerns rooted in perceptions of status, prestige or value of their position

Unfortunately, hourly status has come to be associated with entry-level or lower responsibility work. It is important to try and modernize this type of perception. FLSA and state labor regulations are designed to protect employees and ensure they are fairly compensated. Salaried or hourly status does not affect an employee’s FTE, career architecture mapping, benefits and retirement or accrual of time off.

If an employee has concerns rooted in understanding when overtime is allowed or required

As the supervisor, you and your unit determine overtime expectations and requirements for employees. Please be open and transparent with hourly employees about those expectations and guidelines.

If an employee has questions about how to report time

Please refer employees to the following resources:

- Positive Reporters page for step-by-step guidance

- Time Reporting Deadlines page for time/date deadlines to report time

- UAccess Employee Time & Labor Tools page for video guides

Every state complies with the federal FLSA requirements. However, some states extend or supplement those regulations. This is one of the reasons that there are additional processes for hiring employees outside the state of Arizona, as defined in the Out-of-State Domestic (U.S.) Work Arrangement Guidelines.

Please do not feel obligated to try to navigate and understand multiple state regulations. Allow Human Resources to advise and conduct a compliance review of state regulations. Contact your HR team of generalists and subject matter experts for guidance.

Yes. Employees must be compensated for overtime even if they work it without approval.

However, if a direct report is not following unit expectations, supervisors will need to address the issue to clarify the correct process with the employee and may even need to initiate corrective action steps. Contact your HR team of generalists and subject matter experts for guidance.