Quick References: University's FLSA and Overtime Policy | Salary vs Hourly Guide

The Fair Labor Standard Act (FLSA) is a federal labor law enacted in the United States in 1938. It establishes and regulates various labor standards and employee protections, ensuring fair wages and working conditions. This includes whether employees are exempt from overtime (salaried) or non-exempt (hourly, entitled to overtime) as determined by their compensation and job duties*.

*Although not all salaried employees are exempt from overtime rules under the FLSA, for ease of communication, the university will be referring to exempt employees as “salaried,” and non-exempt employees as “hourly” or “overtime eligible.”

Salaried Employees | Hourly Employees |

|---|---|

| Must be paid a salary above federal or state defined compensation threshold (Review Salary Level Test section). | Typically make less than the federal or state defined compensation threshold, but not always (Review Duties Test section). |

| Only record/report their non-worked time (e.g., time off and leaves) as Exception Time Reporters. | Record their worked time as Positive Time Reporters. |

| Pay doesn't change from a fixed, predetermined amount, regardless of variations in work schedule in a given workweek. Exempt from overtime requirements. | Entitled to overtime pay for hours worked over their regularly scheduled hours. (Review Key Facts for Hourly Employees section). |

Both salaried and hourly employees accrue sick and vacation time. | |

Salary Level Test

Employees are considered overtime-eligible (hourly) if they earn below the federal or state compensation threshold.

Current Federal Compensation Threshold:

- $684/week

- $35,568/year

Salary Basis Test

Salaried employees are paid on a salary basis, meaning pay doesn't change from a fixed, predetermined amount regardless of variations in the work schedule in a given workweek.

Duties Test

Certain positions are considered exempt due to the nature of their job duties. These include executives, administrators and other roles requiring specific skills or education.

Key Facts for Hourly Employees

The FLSA uses the term "non-exempt" in reference to positions that are not exempt from being paid for all hours worked. This double negative may be difficult to follow, but it just means that the position is eligible to receive overtime pay. For our purposes, non-exempt = hourly.

Hourly (Overtime eligible) employees should know the following:

General Information

Definitions

Regular Hours

Hours an employee is regularly scheduled in a workweek, based on Full Time Equivalency (FTE).

Workweek

Begins on Monday at 12:01 a.m. and ends on Sunday at midnight. (Review Time Reporting Deadlines page)

Overtime

Overtime refers to all hours worked beyond an hourly employee's regular hours in a workweek.

Two Types of Overtime

Straight Overtime

When an hourly employee works over their assigned hours but less than 40 hours in a workweek, overtime is paid at their regular hourly rate.

Time-and-a-Half Overtime

When an hourly employee works more than 40 hours in a workweek, overtime is paid at 1.5 times their regular rate.

Two Compensation Options for Overtime

Compensatory (Comp) Time

Comp time compensates employees for overtime hours by giving them time off. It is the preferred and default option when reporting overtime in UAccess.

- Comp time is accrued at either straight or time-and-a-half overtime rates, depending on the employee's regular hours and the number of hours worked.

- Accrued comp time balances are displayed in UAccess alongside vacation and sick time balances.

- Accrual of comp time above a balance of 120 hours (prorated by FTE) must receive a written exception from college/division leadership. The max comp time balance is 240 hours (prorated by FTE).

- The time reporting code for taking comp time is "Comp Time Taken - CTT."

- When comp time is used, it is paid at the employee's most recent pay rate.

Cash Payment

Cash payment means compensating employees for overtime hours by paying directly through a paycheck.

- Cash payments are paid at either straight or time-and-a-half overtime rates, depending on the employee's regular hours and the number of hours worked.

- To elect a cash payment, an employee must choose the Cash option in the UAccess "Pay Overtime" column when entering hours.

- Payment of overtime as cash payments should be discussed with direct supervisors.

Meals, Rest, and Travel Time

Meals and Rest Periods

Meal Periods

Employees should receive one unpaid meal period for each 8-hour workday. The meal period should be no less than 30 uninterrupted minutes. However, the university typically provides for a one-hour unpaid meal period.

Rest/Break Periods

Up to 15 minutes of paid rest may be provided to hourly employees for every segment of four hours worked.

Notes:

- Rest periods cannot be added to a meal period, nor can they be deducted from the beginning or end of the employee's work shift.

- Departmental exceptions to the above information may occur.

Travel Time

If the employee must travel to accomplish a day's work, and the travel is approved by the supervisor, the travel time is paid. This does not include commute travel between home and work.

Paid travel hours count toward the hourly employee's total time worked in a workweek.

Example: Maintenance employees who travel from site to site during the day.

Understanding What Supervisors Can and Cannot Do

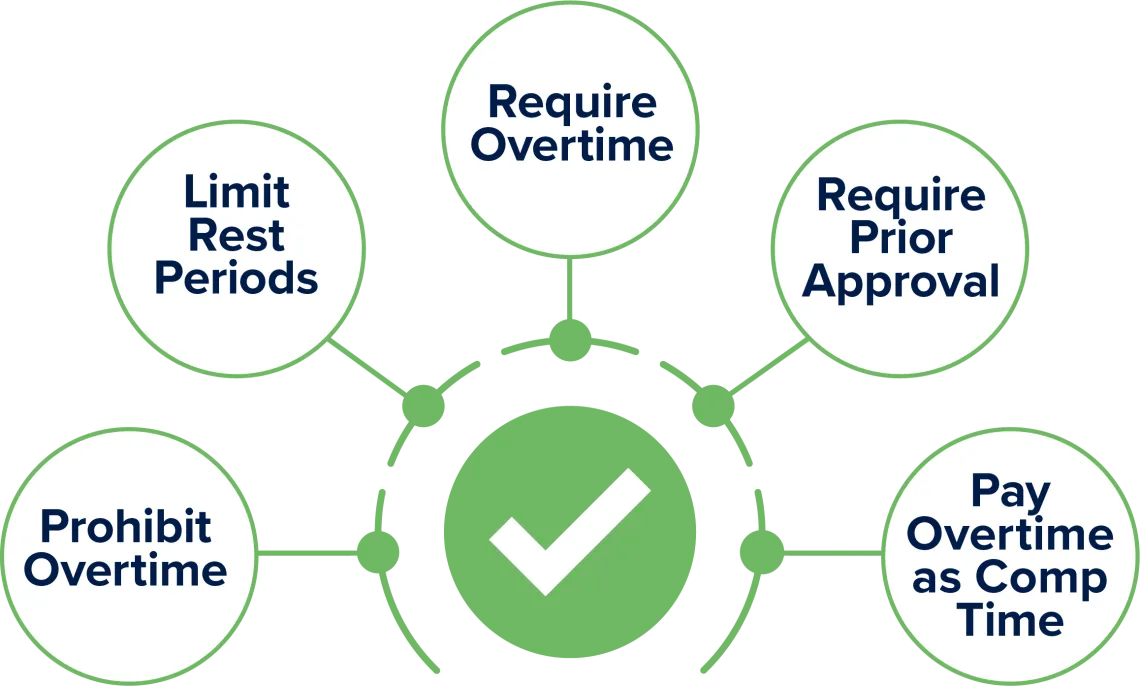

Supervisors CAN

| Require you to work more than your regular hours in a workweek. |

| Prohibit you from working more than your regular hours |

| Require you to receive approval before working more than your regular hours in a workweek. |

| Request that you be compensated with either compensatory time or cash payment. |

| Prohibit or limit paid rest periods if not established college or division practice. |

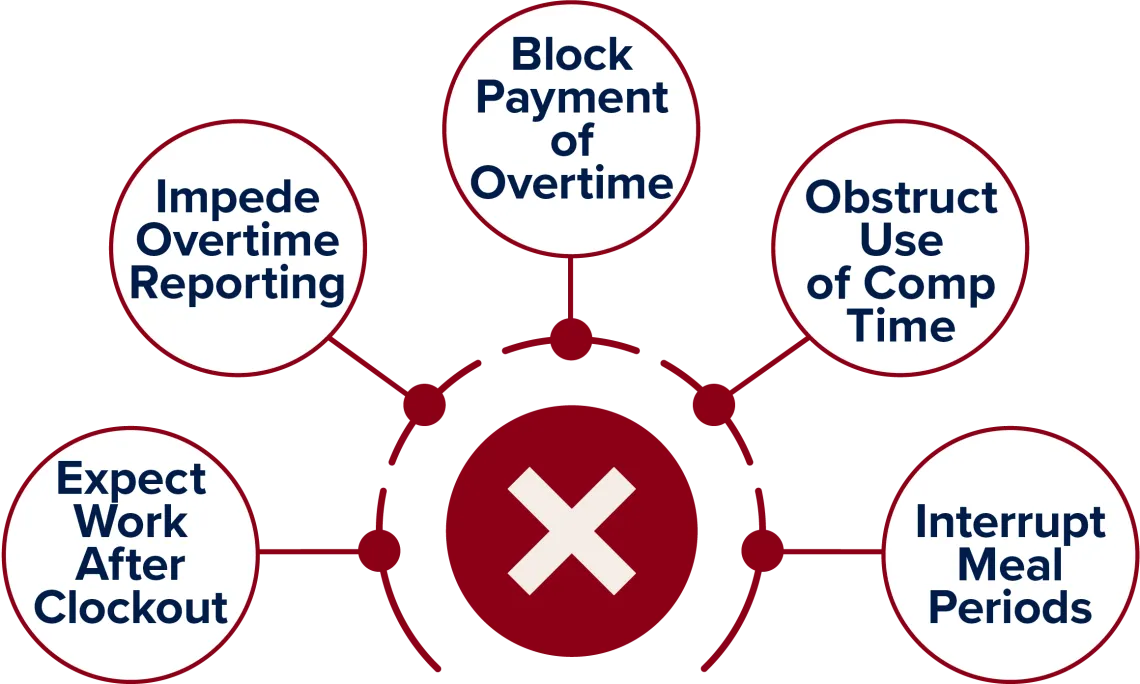

Supervisors CANNOT

| Ask you to clock out and continue working. |

| Pressure you into an unspoken "don't ask, don't tell" situation in which you implicitly know you are expected to work more than your regular hours without overtime pay (e.g., answering emails/calls after hours). |

| Prevent you from being compensated for overtime, even if you worked more than your regular hours without prior approval. |

| Make it more difficult to use compensatory time compared with other accrued time off. |

| Require you to work an 8-hour workday without an uninterrupted meal period of at least 30 minutes (unless there is a specific departmental exception). |