Human Resources Modernization

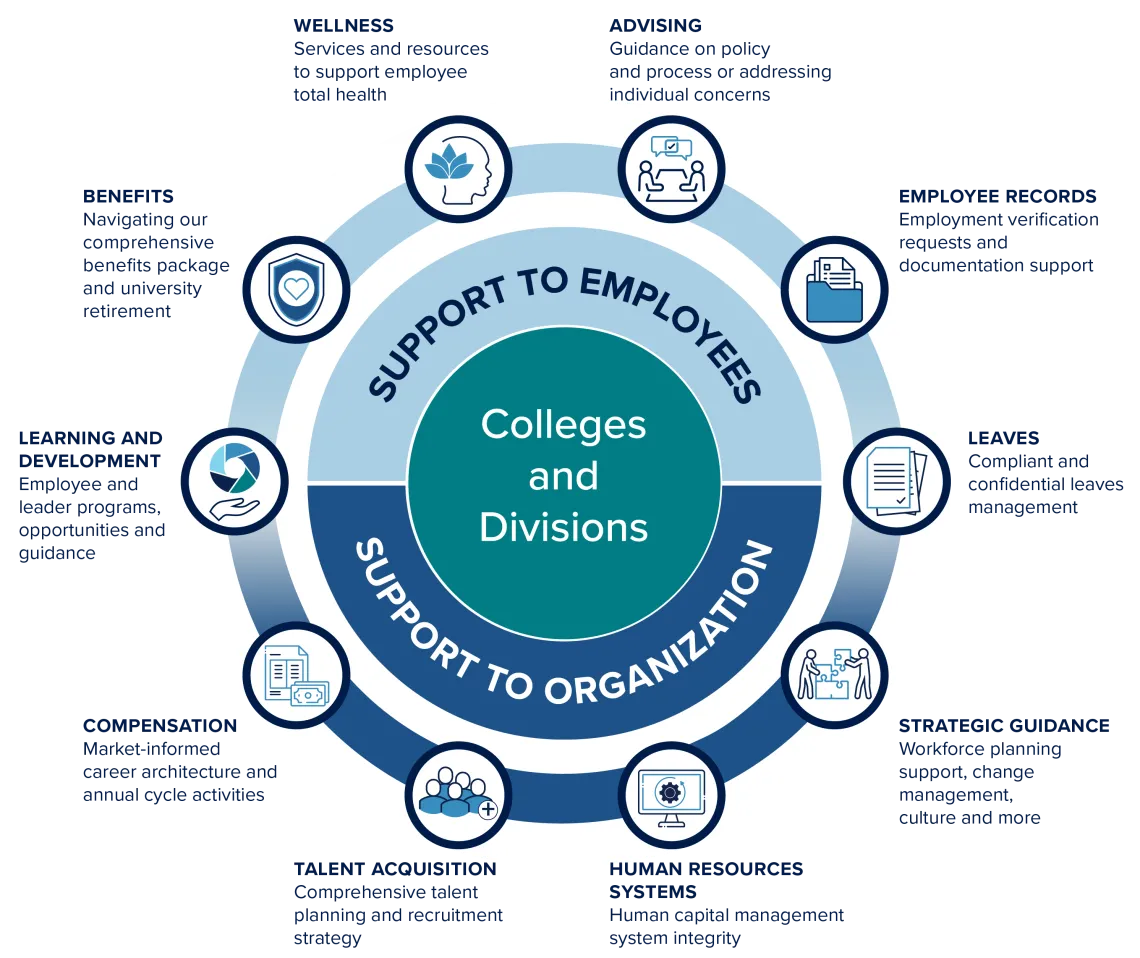

- HR generalists, led by a Senior HR Partner, will provide strategic guidance and systems support for the college or division.

- Other HR subject matter experts, including recruiters, leave advisors, compensation analysts, benefit specialists, and more will provide topic-specific direction, intelligence and tools.

Modernized HR Categories of Support

Benefits

Wellness

Advising

Employee Records

Compensation

Talent Acquisition

HR Systems

Strategic Guidance

Learning and Development

Leaves

Project Goals Summary

Past State: Transactional and Siloed HR

- Inconsistent

- Varying HR processes and procedures across colleges/divisions

- Inconsistent oversight of HR functions across colleges/divisions

- Differences in HR professional service coverage across colleges/divisions

- Inefficient HR processes, procedures and decision making

Disadvantages

- Higher risk and liability exposure

- Errors and rework

- Longer processing times

- Incongruent job responsibilities and increased workload

- Limited accountability for HR processes

- Unclear career paths for HR professionals

Goal State: Modernized HR

- Unified

- Consistency of HR processes and procedures across colleges/divisions

- Accountability across all HR functions

- All colleges/divisions have fully staffed, HR professional service coverage based on their size and needs.

- Establishing positive culture and workplace climate

- Managing employee experience throughout career with the university

- Equipping supervisors to best do their jobs

- Streamlined HR processes, procedures and decision making

Advantages

- Lower risk and liability exposure

- Increased efficiencies in use of HR systems

- Improved processing times

- Continuity of HR operations and services

- Clear career paths for HR professionals

- Better employee experiences

Phases of HR Modernization

Phase | Initiatives | Milestones |

|---|---|---|

Phase 1: Realign Jan. 29-March 4, 2024 | Integrate Human Resources Professionals Address Organizational Needs Maintain Continuity of Current Processes | Feb. 5-28, 2024 Senior HR Partners will notify employees serving in HR roles and their direct supervisors about their new reporting line to the Division of Human Resources. By March 4, 2024 Reporting lines and the home department for HR professionals will officially move to the Division of Human Resources. Colleges and divisions currently without an HR support team will be contacted by their Senior HR Partner and introduced to their support team. |

Phase 2: Refine March 4-June 30, 2024 | Onboard Identify Localized Processes Implement Talent Acquisition Model Establish Leaves Management System | March 4-29, 2024 Orientation and training for those newly integrated into the Division of Human Resources. June 30, 2024 Establish leaves management. Refine practices for Talent job postings and UAccess transactions. Create a road map to unify HR processes and assignments. |

Phase 3: Recalibrate July 1, 2024-June 30, 2025 | Evaluate Talent Fully Integrate Processes Internal Human Resources Assessment | Dec. 23, 2024 Finalize career architecture and mapping of HR positions. March 4, 2025 Engage in continuous improvement process conversations with colleges and divisions. June 30, 2025 Incorporate feedback and finalize updates to HR processes, procedures and decision making. Share transformation progress with colleges and divisions. |

Continued Recalibration July 1, 2025-Beyond | New - March 14, 2025 Based on internal discovery processes from previous phases, in addition to business environmental factors, the initiatives in Phase 3: Recalibrate will extend beyond June 30, 2025, to allow the project to responsibly address the following: HR staffing alignment College and division needs adaptation Business environment navigation Technology capacity accommodation | Same as phase 3. |

Frequently Asked Questions

HR teams will be strategic partners for leadership and employees within colleges and divisions, guiding them across a spectrum of human resource expertise and best-practices:

- Talent acquisition

- Compensation

- Performance management

- Organizational climate and culture

- Employee engagement

- Strategic workforce planning

- Change management

- Leaves of absence management

- HR policies and procedures

- Employee data management

- Benefits and employee wellness

- Retirement

Review current progress of individual modernization activities.

Goals of a modernized management system for employee leaves of absence include:

Dedicated Leaves Management

Human Resources will serve as the contact for employees requesting leaves of absence.

Automate Employee Leave Requests

Employees will request leaves of absence in UAccess Employee. Human Resources will electronically route and store Family & Medical Leave paperwork.

Manage Leave Processes from Start to End

Human Resources will determine eligibility, manage deadlines, ensure leave tracking and conduct employee follow-up.

Ensure Compliance with Regulations

Human Resources will monitor and ensure compliance with federal and state leave laws.

Review current progress of individual modernization activities.

Goals of a modernized talent acquisition system include:

Dedicated Talent Systems Operations

The HR support teams will create and manage all position postings, which will reduce duplicate review of talent acquisition transactions and approval wait time for postings and offer letters.

Establish Talent Acquisition Advisers

Talent acquisition advisers will provide strategic guidance on recruitment strategy, applicant management, and use of the application tracking system.

Enhance Compliance

Human Resources will monitor and ensure compliance with federal and state employment laws (e.g., Equal Employment Opportunity, requirements as a federally contracted institution, and other regulatory requirements).

Strengthen Communication with Applicants

Talent acquisition advisers will work closely with HR support teams and hiring managers to promote timely communication of applicant statuses and search progress.

Review current progress of individual modernization activities.

The current modernization process was launched with the integration of university HR professionals into the Division of Human Resources as part the university's financial action plan. However, it is a successor of a partnership project that had been in the works over the past few years between Human Resources and some colleges and divisions.

HR modernization aims to reduce university costs through standardizing practices, increasing efficiency, and eliminating rework.

Modernization will:

- Provide a more consistent experience university-wide.

- Streamline decision-making.

- Enhance knowledge-sharing among HR teams and to colleges and divisions.

- Mitigate institutional risks.

- Optimize procurement practices.

Review current progress of individual modernization activities.

Benefits Overview

Quick Downloads: 2025 Benefits Guide (PDF) | 2025 Benefits Summary (PDF) | Limited Benefits Eligible vs. Full-Benefits Eligible

Attend a virtual Benefits Orientation session to learn more about your benefits.

Contact Insurance Carriers

Connect with individual insurance carriers' and other providers' customer service departments.

About Dependents

Learn who you can insure as a dependent, how to add or remove dependents, and when you can make changes.

About Beneficiaries

Learn more about choosing a beneficiary, a straightforward method for transferring assets, ensuring your loved ones are provided for after you pass away, and giving you peace of mind.

The University of Arizona proudly offers the following comprehensive benefits package for university employees.

Health Plans

The university pays an average of 88% of medical premiums. You can choose from multiple health plan options (medical, dental, vision, and flexible spending accounts), including coverage for domestic partners and their families.

Note: Employees wishing to enroll a domestic partner should choose the domestic partner plans.

Medical Plans

The Arizona Department of Administration provides medical insurance to state employees, including University of Arizona employees and their legal dependents. Review the information below carefully for details on your options.

Dental & Vision Plans

The Arizona Department of Administration provides medical, dental, vision, and disability insurance to state employees, including University of Arizona employees and their legal dependents.

Domestic Partner Plans

The State of Arizona does not offer benefits to the domestic partners of employees. However, the University of Arizona offers medical, dental, and vision insurance, dependent life insurance, and Domestic Partner Tuition Remission (at the University of Arizona only) to these families.

Patient Protection and Affordable Care Act (ACA): This comprehensive health-care reform law aims to expand Americans' access to affordable health-care insurance. Learn more about how ACA impacts U of A employees.

Life & Disability Insurance Plans

Life Insurance

The university provides $15,000 of term life insurance at no cost. Enrollment in long-term disability insurance is automatic and mandatory as part of your retirement plan

Short- and Long-Term Disability Insurance

Enrollment in long-term disability insurance is automatic and mandatory as part of your retirement plan. Enrollment in short-term disability insurance is voluntary, and premiums are fully employee-paid.

Educational Benefits

Qualified Tuition Reduction (QTR) is a benefit that allows full-benefits eligible employees, retirees, their spouses, dependents, and certain affiliates to take courses at substantially reduced tuition rates at any of the three Arizona public Universities: the University of Arizona (including Global Campus), Arizona State University, and Northern Arizona University. Employees receive additional assistance for graduate courses. There is also a separate program for qualified domestic partners and dependents.

Work/Life Benefits

A fulfilling career is only one part of a fulfilling life. Discover resources, tools, and education that support your well-being in several areas.

Frequently Asked Questions

Visit UAccess Employee and select Employee/Manager Self-Service. Make sure you are on the U of A Employee Main Homepage.

- To view your benefits, click the University Benefits tile.

- To view your paycheck, click the Payroll and Compensation.

15-MINUTE PAYROLL TRAINING

Want more guidance? Take this 15-minute training to walk through how to view and model your paycheck, enroll in direct deposit, choose how you receive your W-2 forms, adjust tax forms and more.

The university cannot supply insurance cards and does not have member information. You need to contact your insurance company directly. Often, you can download a temporary card from the vendor's website. Visit our Contacts page to find vendors' websites, phone numbers, and policy numbers.

If you are employed at the University of Arizona within 30 days of separating from benefits-eligible employment at another Arizona public university or an Arizona state agency, your current benefits continue and you cannot make new elections. You may request reinstatement of your sick leave balance.

To request an agency transfer, please get in touch with Human Resources promptly after your hire date, at 520-621-3660 or hrsolutions@arizona.edu.

Learn more: Employment Change within the Arizona State System Affects Benefits (PDF)

The university is pleased to offer a comprehensive package to postdoctoral scholars that includes all benefits except a mandatory retirement plan. Learn more about benefits options for postdoctoral scholars.

Please review the How Job Change or Separation Affects Your Benefits webpage for detailed information.

Legal Notices

Education Benefits

Qualified Tuition Reduction (QTR) is a benefit provided to full benefits-eligible employees or their qualifying dependents to receive reduced tuition at any of the three Arizona public Universities: the University of Arizona (including Global Campus), Arizona State University, and Northern Arizona University.

QTR for Domestic Partners

The Domestic Partner Tuition Program (DPTP) extends the tuition reduction benefits to employees’ qualified domestic partners and dependents. DPTP is available only for courses at the University of Arizona.

Complete and submit a Qualified Domestic Partner Affidavit and required supporting documentation. This must be approved prior to the start of the semester in which you wish to apply for your domestic partner or their dependent child. For more information, review the eligibility guidelines (below).

Eligibility for DPTP does not extend to university affiliates, employees affected by reduction in force/layoff, employees on long-term disability, or the surviving domestic partner/dependents of a deceased employee.

QTR Eligibility

Employees whose employment is at least .50 FTE and who are full benefits eligible (in a position anticipated to continue at least 6 months) may receive the QTR/EAP benefit for themselves, their spouse/partner, and their dependent children.

Employees must be in active status on the first official start date of the semester in which they wish to apply for QTR/EAP benefits, regardless of the date any specific class begins. For all summer sessions, employees must be active on the first day of the summer pre-session. Visit the University academic calendar for specific dates.

Key IRS Requirements for Eligibility: Children must be claimed on an eligible parent’s tax return to be eligible for the QTR benefit. To be claimed on your tax return, the child must be:

- Your son, daughter, stepson, stepdaughter, adopted child, or foster child for whom you have legal guardianship, and

- Living with you (except for school), and

- Dependent on you for at least half of their support, and

- Under 30 years of age.

A child age 24 or older also must not earn more than $5,200 in income during the calendar year in which QTR/EAP is applied. This may mean that graduate and medical students are ineligible for their last semester.

Please review the Dependent Child Tuition Reduction Eligibility (PDF) questions carefully before submitting a QTR application for a child.

The university is required to conduct random audits at the end of the tax year to ensure that children who received QTR do qualify as dependent children/relatives. If the audit reveals your child was not your dependent, the QTR benefit will be retroactively withdrawn and you will owe tuition.

The employee must be legally married or have a domestic partnership established prior to the start of the semester in which they want to apply on their spouse/domestic partner's behalf. We verify this by requesting marriage certificates or the domestic partner's affidavit.

Retirees: Employees who retire from the University with Official Retirement Status remain eligible for QTR/EAP benefits for themselves, their spouses, and their dependent children. To remain eligible, retirees must take a distribution from their retirement plan within 31 days of their retirement date.

Employees on Leave of Absence: Employees on an approved leave of absence, their spouses, and eligible dependent children continue to be eligible for the QTR/EAP benefits for the duration of the approved absence.

Former Employees: Classified Staff and University Staff employees separated from university employment through reorganization/reduction in force following at least five consecutive years of satisfactory service, along with their spouses and dependent children, remain eligible for QTR/EAP benefits for 12 months following layoff.

Spouses and dependents of deceased employees may remain eligible for QTR/EAP benefits. Please consult the Qualified Tuition Reduction policy.

Affiliate DCCs: Some affiliates and their qualifying dependents are eligible for QTR/EAP. To determine eligibility, please consult the Approved Affiliate Institutions table.

What is Discounted

Use the Bursar Office’s Tuition Calculator to calculate total tuition before and after applying QTR.

Note: QTR only applies to tuition; it does not apply to housing, books, or other fees.

Employees | Spouse | Dependent Child | |

|---|---|---|---|

Tuition Reduction U of A, NAU, and ASU only | Tuition is reduced to $25 per semester/term. | Tuition is reduced to $25 per semester/term. | Tuition is reduced to 25% of in-state tuition amount. |

Tuition Reduction |

|

Includes qualified domestic partners. | Tuition is reduced to 25% of tuition. |

| Credit Hours Covered by QTR and DPTP |

Credits above these ranges are charged at the in-state per-credit resident tuition rate. |

Credits above these ranges are charged at the in-state per-credit resident tuition rate. | No Limit |

| Undergraduate Degree Tax Impact* | Tuition savings are not taxable | Tuition savings are not taxable | Tuition savings are not taxable |

| Graduate Degree Tax Impact* | Tuition savings up to $5,250/year are not taxable. Savings over $5,250 will be taxed as employee income. | The full amount of the QTR benefit is taxed through Payroll Services and comes out of your paycheck. | |

*Tuition Benefits Taxation Guidelines

The Tuition Benefits Taxation Guidelines page provides a general overview of the tax liability of the QTR and DPTP benefits.

This does not constitute tax advice. We strongly encourage you to discuss all tax liability questions with a tax advisor.

How to Apply

QTR applicants must be admitted as students at their respective universities and have a student ID to apply. UAGC does not require a student ID.

Employees

Complete the online application in UAccess Employee each semester/session. After logging in:

- Select the Benefits tile.

- Select Qualified Tuition Reduction.

- Choose QTR Application Form.

For detailed guidance, select one of the following:

Retirees and Certain Employees

Certain retirees and employees on long-term disability must complete:

Affiliates

Once you log into UAccess, select the compass (diamond in a circle) in the top right corner. Then navigate to Self Service > Qualified Tuition Reduction > QTR Application Form.

Employees of the University of Arizona Applied Research Corporation and Campus Research Corporation

Complete the Component Unit Application Form (PDF) and submit it directly to your department for approval, as the departments verify eligibility and then the employee will submit the form to HR to record and submit to the appropriate university.

QTR Application Deadlines

Apply for QTR in UAccess during the following application timeframes. These deadlines apply to all University of Arizona employees, whether using QTR at ASU, NAU, or University of Arizona Global Campus (UAGC), regardless of class start dates. Medical school applications are also subject to these dates and deadlines. Note: You must submit a separate application for each semester or session. However, only one application is required for all summer sessions.

UAGC Note: The UAGC academic calendar is continuous rather than on the semester system. QTR is applied within a benefits period that may not align with semester dates. However, to apply QTR for UAGC courses, an employee must:

- Be active on the first day of the semester during which their desired UAGC course occurs, regardless of when it starts.

- Meet the semester’s QTR application deadline if their desired UAGC course occurs anytime during that semester.

Learn more about UAGC's QTR benefits periods and using QTR at UAGC.

Applications can be submitted online up to three months before the beginning of the semester for which the tuition reduction is requested. However, submitting an online application does not guarantee the continuation of this benefit if the employee's status changes before the first day of the semester. UAGC students can expect to complete the QTR application process 3 times per year.

**If you or your dependent attend ASU or NAU, you must submit a screenshot of your approved application directly to that university’s tuition office. Please see the FAQs below for more information.

| SEMESTER | APPLICATION OPENS | APPLICATION DEADLINE | MUST BE AN ACTIVE EMPLOYEE ON |

|---|---|---|---|

| Summer I/II 2025 | Feb. 19, 2025 | June 22, 2025 | May 19, 2025 |

| Fall 2025 | May 25, 2025 | Sept. 29, 2025 | Aug. 25, 2025 |

| Winter 25/26 | Sept. 21, 2025 | Jan. 13, 2026 | Dec. 22, 2025 |

| Spring 2026 | Oct. 14, 2025 | Feb. 18, 2026 | Jan. 14, 2026 |

Verifying Application Status

Once you have submitted your application online, you can view its eligibility status in UAccess Employee at any time.

- After logging in, select Main Menu > University Benefits > Qualified Tuition Reduction > View QTR Applications.

- To view a specific application, enter your transaction number and click "Search." If you do not know your transaction number, you may click "Search" to view all submitted applications.

Once Human Resources has approved the application, the Bursar’s Office will adjust student account balances within 48–72 hours. Please contact the Bursar’s Office for more information about tuition and student accounts.

Frequently Asked Questions

Qualifications

Guidance is available on the Internal Revenue Service website in Publication 501: Exemptions, Standard Deduction, and Filing Information. See the section on "Exemptions for Dependents."

Important: If your child is 24 or older, there are income limits on how much the child can earn and still qualify as a dependent. (The amount is $5,200 per calendar year for 2025; check the QTR application for future adjustments.) This means children age 24 and older may not be eligible for QTR in their last semester or session. If the child secures a job after graduation, all income earned for the remainder of the calendar year is applied to the income limit. Consequently, an end-of-year audit may reveal that the child has retroactively become ineligible for QTR, and you may be required to reimburse the value of the QTR benefit the following year.

No. Student workers and graduate assistants/associates are excluded from QTR eligibility.

Yes. The Graduate Tuition Waiver may offset any portion of the base tuition that QTR does not cover. QTR is applied first, and the Tuition Waiver award will apply to the remaining balance.

No. GAs who are entitled to tuition benefits through QTR must choose between the two benefit options.

Your Account

If the student is registered for classes and tuition has posted, the tuition reduction will post once it has been entered by the Bursar’s Office. The student will be able to see it in his/her student account in UAccess Student.

If your employment status changes before the first day of the semester or session you have applied for, your application will be automatically deactivated.

If your employment status changes after the semester or session begins, the tuition reduction that was applied to your student account remains in place for the remainder of that semester or session. That means you can complete the course (or courses) you are already enrolled in.

Log in to UAccess Employee. Open the "Benefits" tile, then open the "Qualified Tuition Reduction" drop-down and select "View QTR Applications." Leave the Search Criteria blank and hit "Search." All the QTR applications you have previously submitted will appear, and you can select the one you need.

Yes, you can verify the status of your QTR application in UAccess Employee. After logging in to the Employee Main Homepage select the Benefits tile > Qualified Tuition Reduction > View QTR Applications. Once your eligibility is approved, it is sent to the Bursar's Office for processing. Once processed, the student will be able to see the QTR applied in his/her student account in UAccess Student.

Yes, random audits are conducted every semester. If you are audited, you will be required to submit documentation supporting your application.

Where to use QTR

Yes, if you are enrolled in courses at the University of Arizona, Arizona State University, or Northern Arizona University, you can simultaneously receive the QTR benefit at each university. QTR credit limits still apply. To apply for QTR at two different universities, you must complete the application process twice in UAccess by applying first for one university and then for the other. QTR applications for courses taken at NAU or ASU must be sent directly to those institutions for processing.

No, QTR is not valid for study abroad.

Complete the online QTR application in UAccess Employee. When the online application is approved, there will be a prompt to print a confirmation. The printed confirmation must be turned in at the university where the student will be attending classes. You are responsible for submitting your approved application confirmation to the university (ASU or NAU) you are attending. Check with that university's service center for waiver processing requirements and deadlines.

ASU: Student Accounts Office

Tel: (480) 965-6341

Fax: (480) 965-9242

Email: tuitionreduction@asu.edu

NAU: Office of Student Financial Aid

Tel: (928) 523-4951

Email: EARPform@nau.edu

First, complete the online QTR application in UAccess Employee. When the online application is approved, there will be a prompt to print a confirmation.

Second, you are responsible for submitting your approved application confirmation to UAGC using the Admission Portal. Upload your approved QTR application to the QTR Action Item in your admission portal. For questions, please email employee.application@uagc.edu.

Please visit UAGC’s Qualified Tuition Reduction page for additional information, including application windows that align with UAGC’s continuous academic calendar.

No additional University of Arizona offices need a copy of your application confirmation

Applications

Yes, if you (or your dependent) are planning to take any courses during a semester, submit a QTR application before the deadline for that semester. It is important to submit the application prior to the deadline, even if the class has not started yet (or in some cases acceptance to the University of Arizona may be pending).

An application will be in a "pending" status if supporting documentation verifying the relationship of that dependent has not previously been submitted to the Division of Human Resources. Once documentation is submitted to and approved by Human Resources, the application status will be changed to "approved."

An application will be declined if:

- You did not meet the eligibility requirements for QTR.

- Responses to dependent eligibility questions did not qualify the dependent as eligible (either as a qualifying child or a qualifying relative).

If you have questions about why your application was declined, please contact HR Solutions:

Phone: 520-621-3660

Email: hrsolutions@arizona.edu

Links to Policy

Flexible Spending Accounts

A flexible spending account (FSA) allows you to set aside money pre-tax to use for qualified medical expenses, childcare, or adult and older adult care.

FSA Options

Are you curious about the different health savings account options? Review this comparison chart to make the best decision for you.

Health Care FSA

Co-pays | Deductibles | Medical, dental and vision expenses | Over-the-counter drugs | Illness-related transportation

Annual contribution max: $3,300/participant

Year-to-year rollover: $640 max

Deadline to submit claims: April 30 of the following year

Optional debit card: Use the debit card to pay directly for eligible expenses. Learn more about debit cards.

Note: Enrollees in the High Deductible Health Plan with Health Savings Account may not enroll in the full Health Care FSA, but may enroll instead in the Limited Health Care FSA. The Limited Health Care FSA covers expenses related to dental, vision or out-of-network preventive care services.

Dependent Care FSA*

Childcare | Babysitters** | Nannies | Day camps | Elder care

Annual contribution max: $5,000/household ($2,500 for married, filing separately); this total also includes monies reimbursed or subsidized through the Childcare Choice Employee program and the Back-Up Care program, so please plan accordingly.

New for 2026: $7,500/household ($3,750 for married, filing separately)

Year-to-year rollover: 2.5-month grace period (contributions in a calendar year can be applied to expenses incurred through March 15 of the following year).

Deadline to submit claims: April 30 of the following year

Who is a dependent? (See full definition in the appendix):

- A child under the age of 13;

- A family member or adult who is unable to care for themselves, shares your residence and meets income requirements

* Expenses must be incurred to enable you and your spouse to attend work or school.

** Babysitting cannot be reimbursed if provided by your spouse or one of your own dependent children.

FSA plans undergo required IRS non-discrimination testing to ensure that highly compensated individuals are not disproportionately advantaged. If the university’s plans were not to meet the non-discrimination guardrails throughout a calendar year, households with a household income of more than $150,000 may be required to reduce FSA contributions.

Choosing Your Contribution Amount

When you enroll in an FSA, you must elect an amount to withhold for the plan year. This amount is based on your estimate of your family's annual health and/or dependent-care expenses.

The amount you withhold is "use it or lose it." To avoid losing unused funds at the end of the year, we recommend making conservative estimates of your expenses. The Dependent Care FSA has a grace period, allowing you to claim expenses incurred through March 15 of the following year. The Health Care FSA allows some rollover from one year to the next, but the amount is capped. The Dependent Care FSA has no rollover.

How To Change Your Contribution Amount

You may only change your elected contribution amount in the following situations.

Open Enrollment: Usually occurs in October and November

Qualifying Life Event*:

- Change in family (marriage, birth, etc.)

- Change in employment status

- Change in dependent eligibility

All qualifying life events are listed on the Change Form (PDF).

*You must request changes within 31 days of the event.

Note for Dependent Care FSA participants who participate in the Childcare Choice Program: Beginning January 2027, reimbursements of qualifying childcare will move to a calendar-year basis. During the transition, you may see reimbursements overlap tax years. While your reimbursement submissions can affect which tax year they're applied to, the new higher $7,500 limit gives you more flexibility to manage higher childcare costs and optimize the timing of your reimbursements during the transition period

How To Submit Claims

Our FSA plan administrator: ASIFlex

asiflex.com | 800-659-3035 | asi@asiflex.com

How To Submit Claims

- ASIFlex website

- ASIFlex mobile app (Google Play or App Store)

- By mailing or faxing the claim form (PDF)

- By recurring direct pay (Dependent care FSA only)

Appendix: Plan Documents and Definitions

- Participant Plan Information (PDF)

- Describes plan provisions as well as qualifying and non-qualifying expenses

- IRS Publication 502 (PDF)

- Filing for medical and dental expenses

- IRS Publication 503 (PDF)

- Filing for childcare and dependent-care expenses

Forms

For purposes of claiming expenses under the FSA Dependent Care plan, a qualifying person must be:

- Your dependent child who was (a) under age 13 when the care was provided, (b) for whom you have custody more than 50% of the year, and (c) whom you can claim as an exemption on your federal income tax return; or

- Your dependent (child older than age 13, spouse, parent, or other adult for whom you have custodial responsibility) who (a) is physically or mentally unable to care for himself or herself, (b) shares the same residence with you, and (c) has an income less than the federal exemption amount.